You assess finance charges if you collect late fees or interest on unpaid balances. Learn how to assess finance charges in QuickBooks Desktop, and how to prevent a finance charge from being assessed on an invoice.

Before you start assessing finance charges, you need to set up your Finance Charge Preferences.

- Log in to the QuickBooks company file as Admin.

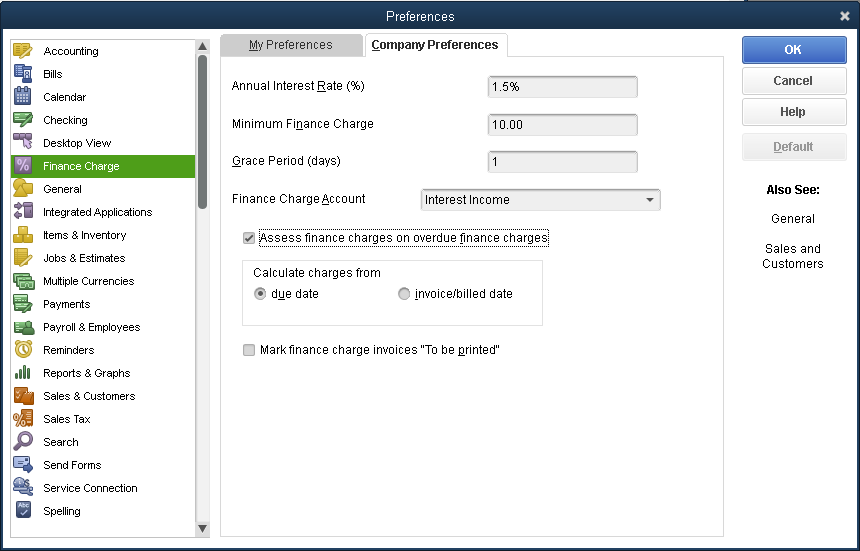

- From the QuickBooks Edit menu, select Preferences.

- On the left pane, choose Finance Charge then go to the Company Preferences tab.

- Fill in the Annual Interest Rate (%), Minimum Finance Charge, and Grace Period (days) fields.

- Annual interest rate: The interest rate that QuickBooks will use to calculate finance charges. QuickBooks assumes the rate is a percentage. For example, type 12.5 if your rate is 12.5%.

- Minimum finance charge: To have QuickBooks apply a minimum finance charge regardless of the amount overdue, enter the minimum charge here.

- Grace period: To give your customers a grace period before finance charges apply, enter the length of the grace period in days. This delays the application of finance charges. For example, if the starting date is June 1st and the grace period is 3 days, QuickBooks waits until June 4 to assess finance charges.

- From the Finance Charge Account drop-down, select the account you use to track income from finance charges .

...

Calculate finance charges from:

- Due date: Starts the day the invoice or statement is due.

...

- (Optional) Put a check mark on the the Mark finance charge invoices as To be printed checkbox if you want to print all your finance charge invoices in a single operation. If you send statements, leave this checkbox cleared. QuickBooks will include the finance charges on the next statement to the customer.

- Click OK.

| Anchor | ||||

|---|---|---|---|---|

|

- From the QuickBooks Customers menu, click Finance Charges/Assess Finance Charges.

- Choose the appropriate A/R account. Note that QuickBooks displays the A/R Account field ONLY when your Chart of Accounts contains more than one A/R.

- Set the Assessment date.

- Select the customers and jobs you want to assess finance charges for.

...

NOTE: When you assess finance charge, QuickBooks creates a Finance Charge Invoice per customer. You have the option to print it or leave it cleared to be included in your next statements.

Prevent a finance charge from being assessed on an invoice

There are two methods available if you want an invoice to be excluded from a customer balance when assessing finance charges.

Option 1: Create a job that's excluded from finance charges.

- From the QuickBooks Customers menu, click Customer Center.

- Select the customer and then click Add Job.

- In the Job Name field, enter Customer Name - No FC then click OK.

- Edit the invoice and change the customer to the job you just created.

- Click Save & Close.

- From the Customers menu, click Assess Finance Charges.

- You can now select which invoices you want to apply finance charges on without choosing the new job's invoice.

Option 2: Create a second Accounts Receivable that you can exclude from finance charges.

- From the QuickBooks Company menu, click Chart of Accounts.

- In the Chart of Accounts window, right click anywhere then select New.

- Click the Other Account Types radio button then from the drop-down, select Accounts Receivable.

- Click Continue.

- In the Account Name field, enter Accounts Receivable - No FC.

- Click Save & Close.

- Edit any existing invoices you would like to prevent from finance charges and select the new A/R account.

...