Used for: Input cash received.

| Anchor | ||||

|---|---|---|---|---|

|

Learn how to record invoice payments in QuickBooks Desktop through the Record Payments form, including how to apply available invoice credits or discount.

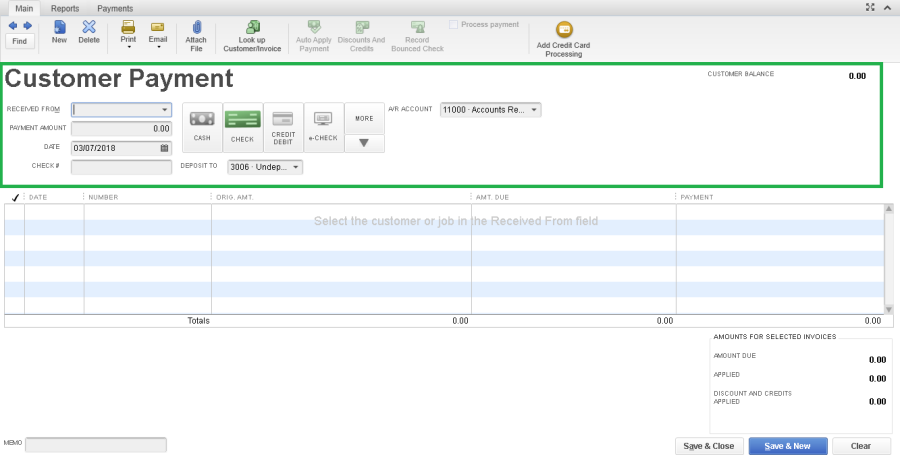

IMPORTANT: By default, the payments go to the Undeposited Funds. If you want the payments to go to a specific bank account instead, you can turn off Undeposited Funds in Payments Preferences. Once the Undeposited Funds is turned off, the Deposit To drop-down will appear on the Receive Payments window. You can click the drop-down so you can choose the account to which you want to deposit the money. See Understand how the undeposited funds account works for more details, including steps to disable Undeposited Funds.

To record a payment

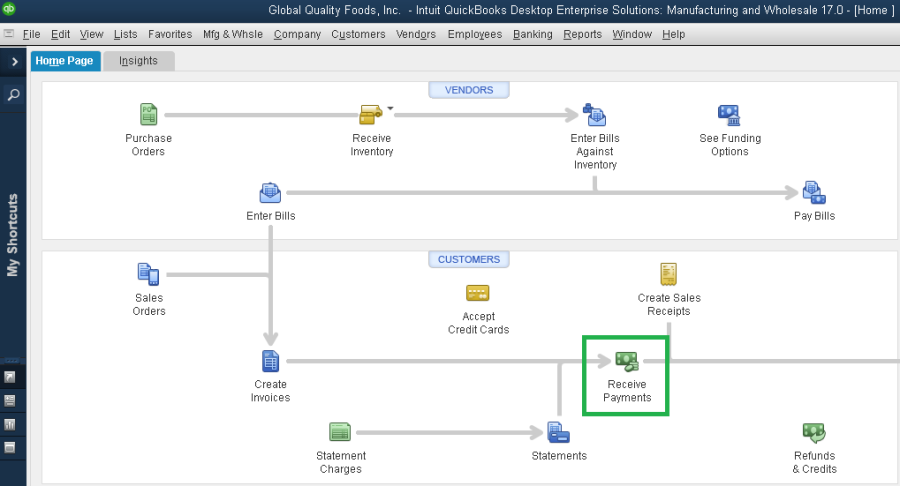

From the QuickBooks Home screen or the Customers menu, click Receive Payments.

Or at the Home page, select the icon as shown below:

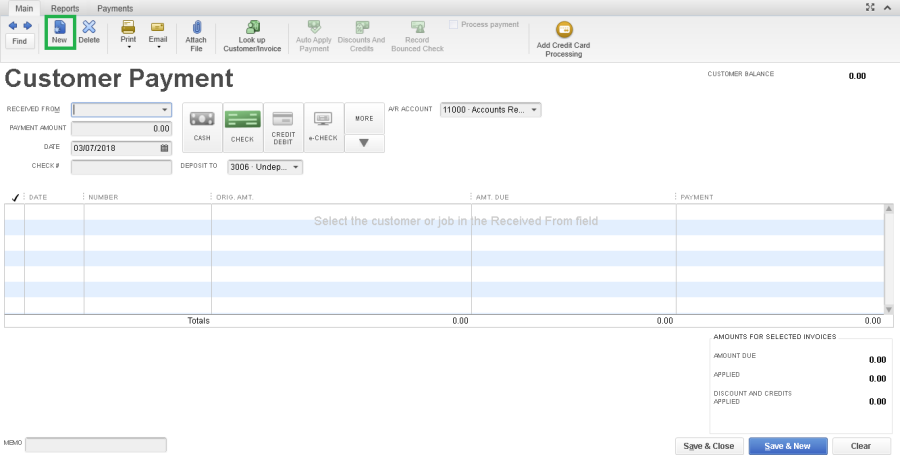

On main screen of Bill, select the icon as shown below:

Enter recevie payment header.

Picture: Header of receive payment.

...

- Date: payment date.

- Payment amount.

- A/R Account.

- Reference#: payment number.

- Payment method: select Cash or Check, Credit/Debit, e-check, Wire Transfer.

- Deposit to: Deposit account. If customer paid by wire transfer method; After you received cash, you must make deposit from menu "Banking -> Make deposit".

Enter invoice for payment.

Select invoice and enter payment amount for invoice and click "Save & Close" or "Save & New".

(Optional) Set any discount or credit you want to apply to the invoices.

- To apply a discount:

You can apply a discount based on customer payment terms or any other concessions/deductions you make in the course of running the business. Note that you can enter any discount amount but it cannot be higher than the invoice amount.

...

- Click Discounts and Credits.

- Put a checkmark on the credit you want to apply.

- If you do not want to use the entire credit or if the credit amount is more than the customer balance, change the amount under the Amt to Use column.

- Click Done to record the credit.

| Anchor | ||||

|---|---|---|---|---|

|

Use sales receipts if you receive full payment at the time of the sale. Sales receipts include payments by cash, check or credit card.

IMPORTANT: If you do not need to track Sales by customer, you can still use Sales Receipt to record your daily sales summary. To do this, set up a customer named Daily Sales (or any name you prefer) and then enter the total sales for the day per Item. If you have multiple cash registers and you want to track the sales per register, you can set up a customer name for each one.

On the QuickBooks Home screen or the Customers menu, go to Create Sales Receipts/Enter Sales Receipts.

...

- If you want to apply a discount, you need to create a discount item.

- From the QuickBooks Lists menu, select Item List.

- Right click anywhere and click New.

- In the New Item window, click the Type drop-down and select Discount.

- Enter an Item Name/Number and a brief Description.

- In the Amount or % field, enter the discount amount or percentage. If your discount amounts vary, you may want to leave the Amount or % field blank and enter the amount directly on your sales forms.

- From the Account drop-down, choose the income account you want to use to track discounts you give to customers.

- Select an appropriate Tax Code for the item then OK.

- Click Save & Close.

| Anchor | ||||

|---|---|---|---|---|

|

You enter a credit memo or refund whenever a customer returns items they have purchased, for which you have already recorded an invoice, customer payment, or sales receipt. If necessary, issue a credit card refund for the returned items.

IMPORTANT: When writing a refund check to a customer, always complete a credit memo first so you can track the sale, return, and refund correctly in QuickBooks.

To create a credit memo:

From the Customers menu, click Create Credit Memos/Refunds.

...

On main screen of Invoice, select the icon as shown below:

Enter Credit Memo header.

Choose the customer name or job you are creating the credit memo or refund check for.

...

- Class.

- Account.

- Date: Credit memo date.

- Credit NO: Credit number.

- Ship to: ship address.

Enter Item for Credit memo.

Enter the items being returned in the line item area.

...

- Retain as an available credit: QuickBooks enters a negative amount in your A/R register for the credit memo. Later, if you receive a payment for this customer, you can use this credit.

- Give a refund: QuickBooks opens the Issue a Refund window. Here, you can issue the refund as cash, a check, or a credit card refund.

- Apply to an invoice: QuickBooks opens the Apply Credit to Invoices window, where you can select an invoice to which you want to apply this credit.

Click OK.

Use Credit to apply to invoice.

On "Credit memo" screen, select icon as shown below:

On "Apply Credit to Invoices" screen, select invoice, enter amount apply and click "Done".

| Anchor | ||||

|---|---|---|---|---|

|

When you receive payments from customers, you can either deposit each payment directly into a QuickBooks bank account, or you can group payments together to be moved to that account later.

Deposit a payment.

If you are depositing payments from you QuickBooks Payments account, check the batch totals before you make the deposit in the QuickBooks Payments (applicable to US only), under Activity and Reports > Deposits. When you have verified the batch totals OR if you don't have QuickBooks Payments account, proceed with the following steps:

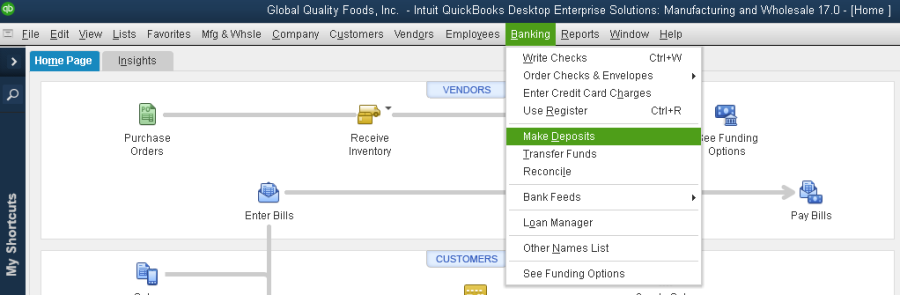

From the QuickBooks Banking menu, click Record Deposits/Make Deposits.

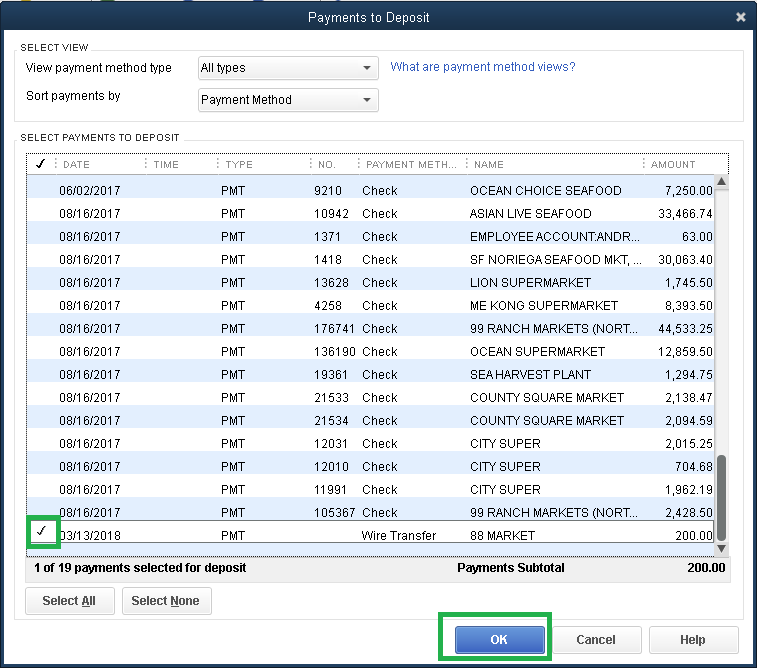

On the Payments to Deposit window that appears, select the payments you want to deposit then click Ok.

NOTE: The Payments to Deposit window, should open automatically. If it doesn't, it may be because your Undeposited Funds account is not turned on OR you have not received any payments yet. To open it, click the Payments button in the Make Deposits window.

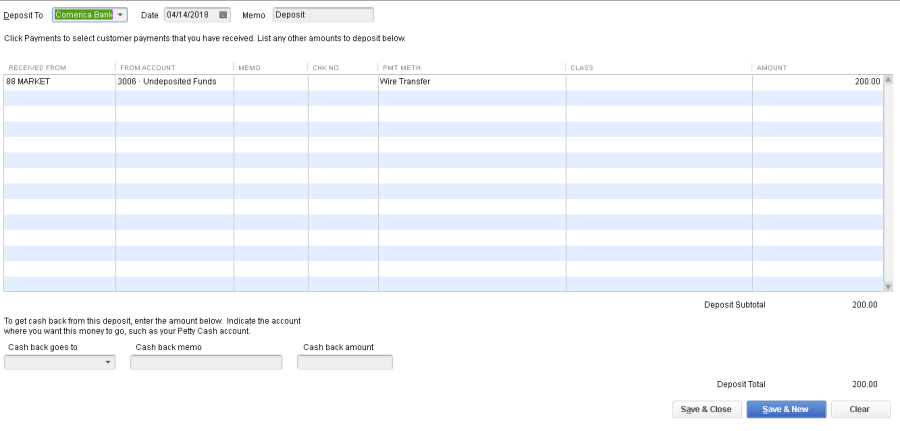

In the Make Deposits window:

...

EXAMPLE: If there are payments for $1,077.50, $5,387.50 and $417.53 and you opted to deposit all of them on 12/15/2020 then your bank Register will show a $6,822.53 deposit for that day. It will be easier for you to reconcile your bank account if you group payments together based on the amount of actual deposit to the bank account.

- Click Save & Close.

Other deposit-related tasks.

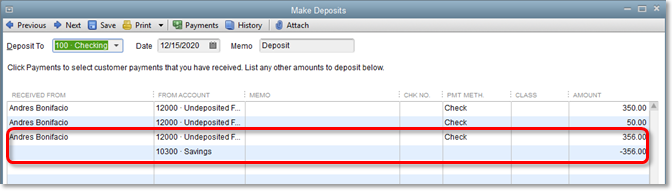

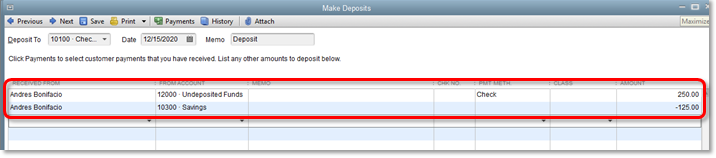

Deposit customer payments into two separate bank accounts

Follow these steps if you need to deposit a portion of your customer payments to a separate bank account.

...

Scenario 1: You have a multiple payments received from a customer ($350, $50 and $356) and you need to deposit one of them ($356) to another account (Savings).

Scenario 2: You have a single payment received from a customer ($250, $50 and $356) and you need to deposit a portion of it ($125) to another account (Savings).

Deposit end-of-day sales to reflect non-posted credit card charges

You have entered an end-of-day Sales Receipt and need QuickBooks to reflect the bank deposit. When entering the deposit, you need to reflect that some of the credit card payments have yet to post. Since all the payments for the day were entered in a single transaction, you need a way to accurately account for the amount deposited and the amount that will not post until later.

To record this deposit, you need to defer the credit card portion of the deposit to a holding account and deposit it.

...

- Click Save & Close.

- Enter a new deposit when the deferred amount has cleared the bank.

- From the QuickBooks Banking menu, select Make Deposits.

- In the Payments to Deposit window, click OK.

- In the Deposit To field, select the appropriate bank account.

- In the From Account field, enter the Deferred Deposit account.

- In the Amount field, enter the amount of the posted deposit.

- Click Save & Close.

Deposit money to an account other than a Bank Account.

On the Make Deposit screen, you can only deposit money to a Bank or Other Current Asset account by default. If you encounter a scenario wherein you need to record a deposit to a different account type, you can use the Cash Back goes to option.

- From the QuickBooks Banking menu, choose Make Deposits.

- Click the Cash back goes to drop-down and choose the desired account.

- On the Cash back amount field, enter the amount you want to add to the Cash Back account. If you do not want any of the funds to go to the Bank account, enter the full amount of the deposit here.

- Click Save & Close.

Record recurring deposits.

Follow these steps to create recurring deposits from a customer.

IMPORTANT: Skip Step 1 and proceed to Step 2 if you have already recorded the deposit in QuickBooks.

...