In QuickBooks, you can use estimates to create a bid, proposal, or quote. The estimate can later be turned into a sales order or an invoice.

Before you can start creating estimates, you need to make sure the Estimates feature is turned on.

- Sign in to the QuickBooks company file as Admin.

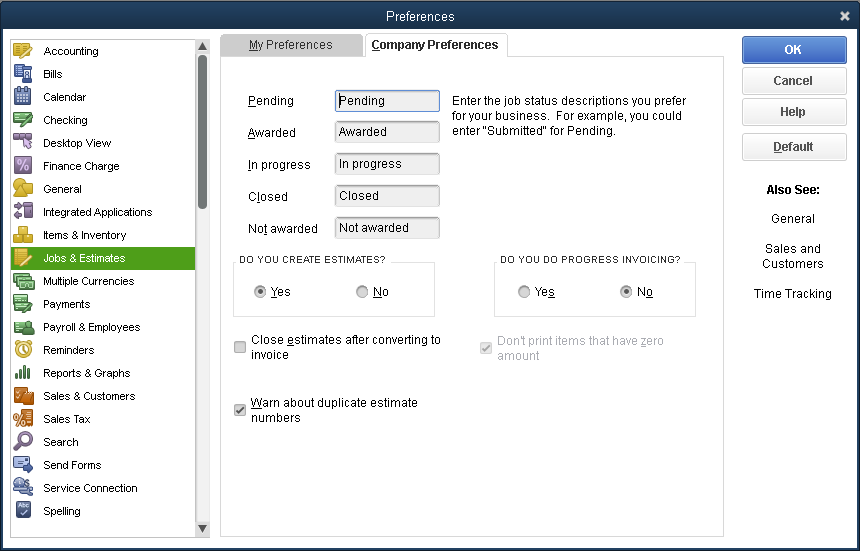

- From the QuickBooks Edit menu, select Preferences.

- On the left pane, choose Jobs & Estimates then go to the Company Preferences tab.

- Select Yes to the question "Do you create estimates?"

- Click OK.

Workflow: Estimate - Sales Order - Invoice - Payment – Deposit.

Use this workflow if you need to send a proposal or quote to your customer that you will later turn to a sales order before you create an invoice and collect payments.

IMPORTANT: Sales Order is only available in QuickBooks Desktop Premier or Enterprise.

This workflow contains the following steps:

- Step 1: Create an estimate.

- Step 2: Create a sales order.

- Step 3: Create an invoice.

- Step 4: Record a payment.

- Step 5: Deposit customer payments.

Create an estimate.

- From the QuickBooks Home screen or on the Customers menu, select Estimates / Create Estimates.

- On the Customer: Job drop-down, select a customer or customer job. If the customer or job is not on the list yet, you can click Add New.

- Fill in the relevant information at the top of the form like the Date and Estimate/Quote #.

- In the detail area, select the item(s) you propose to do or include as a sale.

Note: When you select or add an item, the description and amount are automatically populated based on the description and unit cost entered when the item was set up. You can delete or modify this when creating Estimates.

- (Optional) If you want to apply a discount, you need to create a discount item.

- From the QuickBooks Lists menu, choose Item List.

- Right click anywhere and select New.

- In the New Item window, click the Type drop-down and select Discount.

- Enter an Item Name/Number and a brief Description.

- In the Amount or % field, enter the discount amount or percentage. If your discount amounts vary, you may want to leave the Amount or % field blank and enter the amount directly on your sales forms.

- From the Account drop-down, choose the income account you want to use to track discounts you give to customers.

- Select an appropriate Tax Code for the item then OK.

- Click Save & Close.