Used for:

- Reconcile Comerica credit card and bank accounts.

- Input service charge, interst earned for bank account.

Reconciliation is the process of matching transactions you entered in QuickBooks with your bank or credit card company's records. It is highly recommended that you reconcile your bank/credit card accounts in QuickBooks on a regular basis to ensure accuracy of your accounting records. More specifically, reconciliation helps ensure that:

- All your transactions such as payments, deposits, and bank fees are accounted for in QuickBooks.

- All transactions in your QuickBooks bank register, as well as its ending balance, match what you have in your actual bank account.

Before you start reconciling the account, make sure you have:

- Backed up your QuickBooks company file.

- Set up the bank or credit card account in QuickBooks with the correct beginning balance.

- Entered all uncleared transactions for the statement period.

- Received a copy of your bank or credit card statement.

The Reconciliation Process.

You will come across two main screens as you start and complete the reconciliation process.

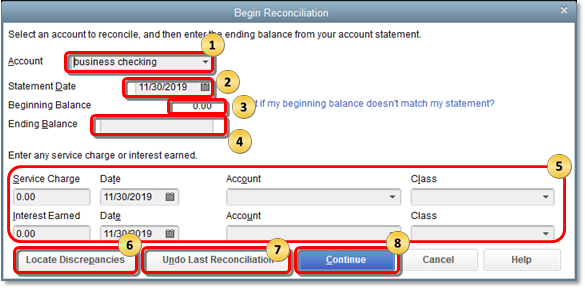

The Begin Reconciliation window.

In this window, you choose the account to reconcile and review all the information corresponding to it. It is important that all information in this window is accurate before proceeding to the next step.

To go to the Begin Reconciliation window, go to the Banking menu and click Reconcile.

Or at the Home page, select the icon as shown below:

On "Begin Reconciliation", enter information:

- In the Account field, select the bank or credit card account you want to reconcile.

- The Statement Date is automatically filled in. Usually it is 30 or 31 days after the statement date you entered for the previous reconciliation. You can change it as needed.

- The Beginning Balance is automatically filled in. It is the sum of all previously cleared transactions. Make sure it is the same as the opening balance shown on your statement.

- In the Ending Balance field, enter the corresponding balance from your statement.

- If the financial statement shows a service charge or interest that you haven't yet entered into your QuickBooks records, enter those amounts into the Service Charge and Interest Earned section. Do NOT enter charges you have already entered as QuickBooks transactions.

- Click Locate Discrepancies to see available reports that will help you track discrepancies and other reconciliation issues. You will also be given the option to Undo and Restart Reconciliation on the Locate Discrepancies window.

- Click the Undo Last Reconciliation button if troubleshooting requires you to revert to the previous reconciliation.

Why do I need to undo last reconciliation?

You will normally need to undo last reconciliation when you cannot locate discrepancies during reconciliation or if you want to change the date of the opening balance. Note that when you undo previous reconciliation, your beginning balance will revert to the previous beginning balance and all previously cleared transactions will be uncleared.

- If all information is correct, click Continue to proceed to the Reconcile window.

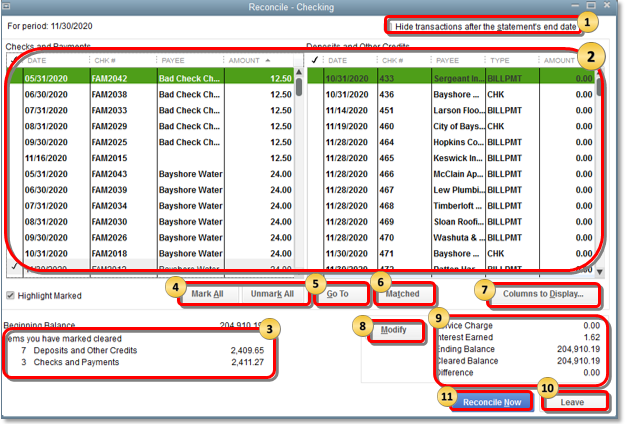

The Reconcile screen.

In this window, you can refine the choices you want to match against your bank statement. This is where you select transactions to clear. If this window shows a zero difference after you select all transactions that appear on your statement, then congratulations! You can simply click the Reconcile button and you're done reconciling the account.

- Hide transactions after the statement's end date: Put a check mark in the box if you want to display the transactions covered only by the statement period you are working on. This will help avoid confusion especially if you are "behind" in the reconciliation process.

- The transactions entered in QuickBooks: These are listed and divided into two sections – the Checks/Cheques and Payments (Money out) and Deposits and other Credits (Money in). If you are reconciling a credit card account, the sections are Charges and Cash Advances (purchases) and Payments and Credits (payments to the credit card company). Check the transactions against what you have on your bank or credit card statement. Click only the ones that appear on your statement and ensure the amounts are the same. Note that as you select transactions, the Cleared Balance changes.

What if there are too many transactions?

By default, the transactions are listed according to date. If there are too many transactions for the statement period, it may be easier for you to resort transactions, especially if you are trying to find a transaction with a specific amount, reference #, etc.

Click the header/title of the column you want to resort. Clicking it once automatically sorts the transactions. Clicking it a second time reverses the sort. For example, if you want to arrange transactions according to amount, click the Amount column header. The transactions are rearranged in ascending or descending order.

- Items you have marked cleared: This section displays the total number and the total amount of Deposits and Checks you've selected. Some bank provides the same summary of transactions on their statement. Looking at this section will save you time if you need to check for discrepancies.

- Mark All/Unmark All: Click either of these buttons to select/deselect transactions. If you reconcile on a regular basis and if all transactions for the statement period were entered correctly, selecting all transactions at once may save you time. Just make sure the reconcile window shows a zero difference between the ending balance and cleared balance.

- Go To: Click this button to open (and edit) the transaction from the reconciliation window. This is helpful if you need to do minor edits on the transaction before you mark it reconciled or cleared.

- Matched: If the account you are trying to reconcile is setup for online banking, clicking this button will automatically select the transactions that were downloaded and auto-matched.

- Columns to Display: Click this button to choose the fields you want to display.

Why do you need to choose columns?

By default, QuickBooks displays the Date, CHK/CHQ #, Payee and Amount columns. Except for the Amount column, you can add or remove the other fields to help avoid confusion. For example, if your statement shows the reference # for most transactions, you can choose to display only the CHK/CHQ # and AMOUNT columns. This way, you can easily find and mark transactions.

- Modify: Click this button if you have last minute changes on the information you entered in the Begin Reconciliation window.

- This section provides you with a glimpse of the reconciliation figures.

- Service Charge, Interest Earned, and Ending Balance: They are all based on the amount you entered for these fields in the Begin Reconciliation window.

- Cleared Balance: The figure decreases as you select/clear checks and payments and increases as you select/clear deposit and other credit amount.

- Difference: This gives you the difference between the beginning balance you entered and the cleared balance (the transactions you've selected so far). Ideally, this should be zero.

- Leave: Click this button if you need to go out of the reconcile window to work on another account or to edit transactions.

What happens when I click the Leave button?

QuickBooks keeps track of the transactions you already marked as cleared – that is, they remain checked in the Reconcile window. When you go to the account register, an asterisk is displayed in the cleared column of the transactions you marked until you complete the reconciliation. The asterisk indicates that a transaction is pending because you haven't finished reconciling your QuickBooks account with your financial statement.

When you are ready to resume reconciling, you need to go back to the Begin Reconciliation window, re-enter the beginning balance and proceed with reconciliation as usual.

- Reconcile Now: Click this button if you are done selecting all transactions.

What happens next?

If the difference is zero: QuickBooks saves the reconciliation and displays the Select Reconciliation Report window. Choose the type of report and then click either Display or Print. Click Close if you do not need any reports at this time.

QuickBooks gives you the option to choose between Reconciliation Summary or Reconciliation Detail report, or select both. Though not displayed after you completed the reconciliation process, the Reconciliation Discrepancy Report is also available in QuickBooks to help you figure out any discrepancy or issue when reconciling the account.

If the difference is anything but zero: QuickBooks displays the Reconcile Adjustment window. The options available in this window are:

If you need to locate the journal entry, you can:

- Return to Reconcile: if you need to go back to the previous window.

- Leave Reconcile: if you need to go out of the reconciliation window so you can review or edit existing transactions that are causing the discrepancy.

- Enter Adjustment: if you want to complete the reconciliation process although you didn't get a zero difference on the previous window. QuickBooks will automatically enter a Journal Entry under a special expense account called Reconciliation Discrepancies. You can check and edit it as needed by going to your Chart of Accounts.

- Use the Find feature.

- From the Edit menu, click Find.

- On the Find window, go to the Advanced tab and select the Memo filter.

- In the Memo field, type Balance Adjustment and click Find.

- Any balance adjustment will be displayed.

- View the Previous Reconciliation report.

- From the Reports menu, click Banking > Previous Reconciliation.

- If a balance adjustment was made, you will see a General Journal Entry at the top of the report under the Cleared Transactions section.

FOR CREDIT CARD ACCOUNTS: If your ending balance is anything but zero, QuickBooks will display the Make Payment window and prompt you to write a check or enter a bill to pay for the outstanding balance. If you do not want to record payment, you can click Cancel.

Zero or incorrect Beginning Balance in the Begin Reconciliation Window.

When you open the Begin Reconciliation window and select an account to reconcile, the Beginning Balance is zero or incorrect.This may be due to one of the following reasons:

- No balance or an incorrect balance was entered when the account was set up.

- Previously cleared and reconciled transactions were voided, deleted, or modified.

- The file was converted from a different version of QuickBooks.

- Possible data damage.

To correct a zero balance:

Recreate the opening balance.

If it is your first time reconciling the account, you can recreate the opening balance but the option is not available in the Begin Reconciliation window. However, you can create a journal entry then do a mini-reconciliation to correct it.

- Create a journal entry using the correct date and amount you want to see in the Begin Reconciliation window.

- From the Company menu, click Make General Journal Entries.

- Change the date to the correct statement date of your beginning balance.

- Select the appropriate account from the Account drop-down.

- Enter the correct opening balance in the Debit column.

- On the second line, select the account you want to Credit.

- Click Save.

- Do a mini-reconciliation to correct the Beginning balance in the Begin Reconciliation window.

- From the Banking menu, click Reconcile.

- Select the appropriate account from the Account drop-down.

- Enter the statement date and ending balance that match your journal entry.

- Click the Continue button.

- In the Deposits and Other Credits section, select the corresponding Journal Entry.

NOTE: The amount shown for the Difference should now be zero.

- Click the Reconcile Now button.

To fix an incorrect balance:

Correct edited, deleted, or cleared transactions.

- To find the transactions causing the discrepancy, run any of these reports:

- Reconcile Discrepancy report.

- From the Reports menu, select Banking then click Reconciliation Discrepancy.

- Choose the appropriate Account and click OK.

- You now have a list of transactions that were changed since the last reconciliation.

- Use this report to identify the transaction/s causing the issue.

- If you find a discrepancy, note the transaction date and the Entered/Last Modified, which will tell you when the change occurred.

- Audit Trail report.

- From the Reports menu, select Banking then click Previous Reconciliation.

- Select appropriate account being reconciled.

- Select the most recent Statement date and select the option to include "Transactions cleared at the time of reconciliation. (Report is displayed as a PDF file)."

- Note the Statement date at the top of the report and the reconciliation creation date in the upper left of the report.

- From the Reports menu, select Accountant & Taxes then click Audit Trail.

- Set the Account filter for the account being reconciled.

- Select Customize Report.

- Select the Filters tab and click on Account from the options.

- From the Account drop-down, select the appropriate account.

- Set the Date filter with the From field blank and the To date set to the statement date.

- Click OK.

- Set the Entered/Modified filter with the From date set to the previous reconciliation creation date from the PDF, and the To field as today's date.

- See if any of the transactions in the report can account for the discrepancy.

- Previous Reconciliation report.

Note: If you are using QuickBooks Desktop Pro, you can only access the last reconciliation report. To keep a copy of the other reports, you can save a PDF copy on your hard drive. See view previous bank reconciliation reports to learn more.

- From the Reports menu, select Banking then click Previous Reconciliation.

- Select the appropriate Account and Statement Ending Date then click Display.

- Compare this report to past statements from your financial institution.

- To correct the discrepancy, you may need to re-enter or edit the transactions. You can also try one of the following options:

- Undo a previous reconciliation and redo it

- Back up the QuickBooks company file.

- In the Begin Reconciliation window, click Undo Last Reconciliation.

- When prompted, click Continue then OK to complete the process.

- Close and re-open the Begin Reconciliation window.

- Ignore the discrepancy and let QuickBooks enter an offsetting adjustment

Although you didn't get a zero difference, you can still complete the reconciliation process by clicking Enter Adjustment. QuickBooks will automatically enter a Journal Entry under a special expense account called Reconciliation Discrepancies. You can check and edit it as needed by going to your Chart of Accounts.

If you need to locate the Journal Entry, you can:

- Use the Find feature:

- From the Edit menu, click Find.

- On the Find window, go to the Advanced tab and select the Memo filter.

- In the Memo field, type Balance Adjustment and click Find.

- Any balance adjustment will be displayed.

- View the Previous Reconciliation report.

- From the Reports menu, click Banking > Previous Reconciliation.

- If a balance adjustment was made, you will see a General Journal Entry at the top of the report under the Cleared Transactions section.

- Contact your bank about a banking error

If the discrepancy is caused by a banking error that appears when you download or import transactions, it is best to contact your bank as the majority of Bank Feeds errors are resolved on their end. For proper assistance when contacting your bank, ask to be transferred to a bank representative familiar with QuickBooks Bank Feeds and account activation.

Fix reconciliation discrepancies.

Reconciliation in QuickBooks is done to make sure that it accurately reflects your business transactions. If you have previously reconciled an account but it shows a different balance in the next reconciliation, your account has reconciliation discrepancies.

Reconciliation discrepancies may be caused by one of the following reasons:

- Previously reconciled transactions have been modified, deleted, or added

- Reconciliation adjustments (Journal entries, etc.)

Depending on the cause, follow these steps to fix reconciliation discrepancies:

Modified, deleted, or added transactions

There are several reports available in QuickBooks that will help you identify discrepancies.

Reconciliation Discrepancy Report: This report shows transactions sorted by statement date that were changed since the last reconciliation.

- From the Reports menu, select Banking then click Reconciliation Discrepancy.

- Choose the appropriate account then click OK.

- Review the report to identify any discrepancies.

Missing Checks Report: This report helps you verify missing transactions.

- From the Reports menu, select Banking then click Missing Checks.

- Choose the appropriate account then click OK.

- Review the report for transactions that don't match your bank statement.

Transaction Detail Report: This report helps you verify transactions that were changed or modified.

- From the Reports menu, select Custom Reports then click Transaction Detail.

- Under the Display tab, choose the following:

- Date From = the earliest QuickBooks date (or leave blank)

- Date To = The date of last reconciled statement

- Under the Filters tab, choose the following:

- Account = the account being reconciled

- Entered/Last Modified

- Date From = Date of the last reconcile

- Date To = Today

- Click OK to run the report.

Important:

- Once a discrepancy is identified, you need to make the necessary corrections. If you need assistance on how to make these corrections, please consult your accounting professional.

- If you have new transactions to add to the reconciliation period or if you have modified previously reconciled transactions, you may need to do a mini-reconciliation.

Reconciliation adjustment

A forced previous reconciliation which resulted to a reconciliation adjustment may also cause discrepancy. To fix this issue, you need to review the Reconciliation Discrepancy account for inappropriate adjustments.

- From the Lists menu, click Chart of Accounts.

- Select and double-click the Reconciliation Discrepancies account.

- From the Dates drop-down, select the appropriate filter.

- If you're unable to identify the transaction/s in the register that need to be corrected, you will need to undo the previous reconciliation until the opening balance is correct.

- Once the opening balance is correct, you can proceed with reconciling the current month making sure the opening balance is correct for each month. If you encounter an incorrect beginning balance for a specific month, you can just correct it.

- If a transaction from years ago was changed or deleted recently, you may need to undo bank reconciliations for the past however many years to get to where the opening balance is correct.