...

Reconciliation is the process of matching transactions you entered in QuickBooks with your bank or credit card company's records. It is highly recommended that you reconcile your bank/credit card accounts in QuickBooks on a regular basis to ensure accuracy of your accounting records. More specifically, reconciliation helps ensure that:

- All your transactions such as payments, deposits, and bank fees are accounted for in QuickBooks.

- All transactions in your QuickBooks bank register, as well as its ending balance, match what you have in your actual bank account.

...

- Backed up your QuickBooks company file.

- Set up the bank or credit card account in QuickBooks with the correct beginning balance.

- Entered all uncleared transactions for the statement period.

- Received a copy of your bank or credit card statement.

The Reconciliation Process.

You will come across two main screens as you start and complete the reconciliation process.

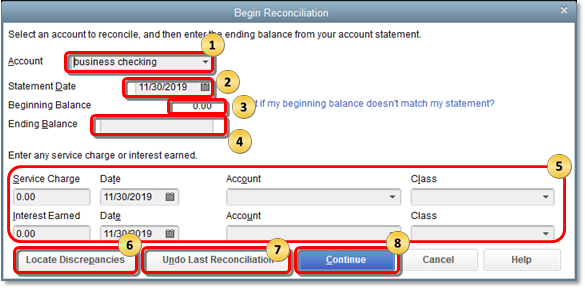

The Begin Reconciliation window.

In this window, you choose the account to reconcile and review all the information corresponding to it. It is important that all information in this window is accurate before proceeding to the next step.

To go to the Begin Reconciliation window, go to the Banking menu and click Reconcile.

...

- If all information is correct, click Continue to proceed to the Reconcile window.

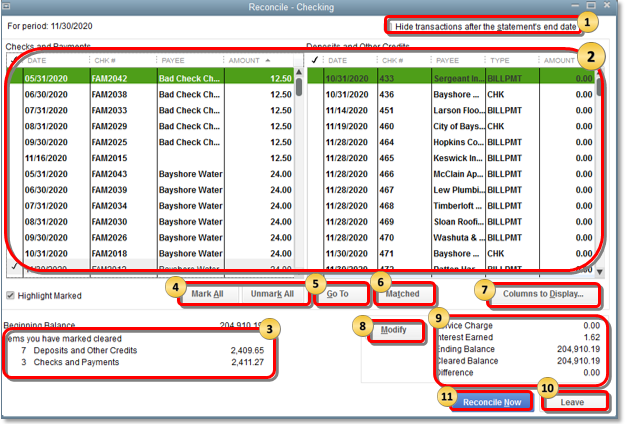

The Reconcile screen.

In this window, you can refine the choices you want to match against your bank statement. This is where you select transactions to clear. If this window shows a zero difference after you select all transactions that appear on your statement, then congratulations! You can simply click the Reconcile button and you're done reconciling the account.

...

FOR CREDIT CARD ACCOUNTS: If your ending balance is anything but zero, QuickBooks will display the Make Payment window and prompt you to write a check or enter a bill to pay for the outstanding balance. If you do not want to record payment, you can click Cancel.

Zero or incorrect Beginning Balance in the Begin Reconciliation Window.

When you open the Begin Reconciliation window and select an account to reconcile, the Beginning Balance is zero or incorrect.This may be due to one of the following reasons:

- No balance or an incorrect balance was entered when the account was set up.

- Previously cleared and reconciled transactions were voided, deleted, or modified.

- The file was converted from a different version of QuickBooks.

- Possible data damage.

To correct a zero balance:

Recreate the opening balance.

If it is your first time reconciling the account, you can recreate the opening balance but the option is not available in the Begin Reconciliation window. However, you can create a journal entry then do a mini-reconciliation to correct it.

...

- Click the Reconcile Now button.

To fix an incorrect balance:

Correct edited, deleted, or cleared transactions.

...

If the discrepancy is caused by a banking error that appears when you download or import transactions, it is best to contact your bank as the majority of Bank Feeds errors are resolved on their end. For proper assistance when contacting your bank, ask to be transferred to a bank representative familiar with QuickBooks Bank Feeds and account activation.

Fix reconciliation discrepancies.

Reconciliation in QuickBooks is done to make sure that it accurately reflects your business transactions. If you have previously reconciled an account but it shows a different balance in the next reconciliation, your account has reconciliation discrepancies.

Reconciliation discrepancies may be caused by one of the following reasons:

- Previously reconciled transactions have been modified, deleted, or added

- Reconciliation adjustments (Journal entries, etc.)

Depending on the cause, follow these steps to fix reconciliation discrepancies:

Modified, deleted, or added transactions

There are several reports available in QuickBooks that will help you identify discrepancies.

Reconciliation Discrepancy Report: This report shows transactions sorted by statement date that were changed since the last reconciliation.

...

Transaction Detail Report: This report helps you verify transactions that were changed or modified.

- From the Reports menu, select Custom Reports then click Transaction Detail.

- Under the Display tab, choose the following:

...

- Once a discrepancy is identified, you need to make the necessary corrections. If you need assistance on how to make these corrections, please consult your accounting professional.

- If you have new transactions to add to the reconciliation period or if you have modified previously reconciled transactions, you may need to do a mini-reconciliation.

Reconciliation adjustment

A forced previous reconciliation which resulted to a reconciliation adjustment may also cause discrepancy. To fix this issue, you need to review the Reconciliation Discrepancy account for inappropriate adjustments.

...